Especially for New Muslim Reverts, here’s some sharing for you!

Islamic inheritance laws, known as ‘Faraid’, have roots stretching back over 1,400 years, forming a critical part of the broader framework of Shariah, or Islamic law. Embracing both religious and legal dimensions, these laws aim to ensure a fair distribution of a person\’s estate after their death, reflecting the importance placed on family and community in Islam.

These inheritance laws are not just relics of the past but remain highly relevant in contemporary society. With an underlying goal of promoting social harmony and ensuring economic stability. The purpose is to guide Muslims in managing their wealth and estates. This enduring significance is partly because they are considered a divine commandment, thus carrying both legal weight and spiritual significance.

When placed alongside the inheritance laws of other cultures and religions, Islamic laws present unique characteristics. While some traditional legal systems prioritize primogeniture or male-preference, Islamic inheritance laws mandate predetermined shares for family members, ensuring a wider distribution of wealth. This method seeks to embody principles of fairness, offering a stark contrast to the inheritance practices seen in some other traditions.

Whether you\’re exploring these laws out of academic interest or because they\’re a direct part of your life, understanding the principles and applications of Islamic inheritance laws can offer invaluable insights into both the past and present societal structures.

Basic Concepts and Principles

Understanding Islamic inheritance laws requires a grasp of the fundamental framework laid out by Shariah. This framework, grounded in divine command, highlights the structured approach Islam takes in wealth distribution after death.

It’s vital to get comfortable with key terminologies that frequently pop up in these discussions. ‘Wasiyyah’ refers to bequests which can be given to non-heirs up to one-third of the estate. Then there’s ‘Mirath’, representing the share of inheritance each heir rightfully receives. Finally, ‘Faraid’ concerns the fixed shares prescribed by the Quran. Crushing these terms will arm you with the foundational knowledge needed.

A standout principle of Islamic inheritance is the emphasis on equity and justice. The system is designed to avoid disputes among heirs, focusing more on family unity and fairness. By providing fixed portions to various relatives, from spouses to siblings, the intent is to minimize potential conflicts. This differs a lot from systems that might leave everything to negotiation or the wishes outlined in deceased’s will.

This structured system doesn’t just dole out portions randomly but aims to uphold moral and ethical standards in distribution. It seeks to respect the rights of women and minors, which, given the era these laws originated, was quite progressive. The idea was to ensure that no one was left vulnerable to economic hardships after the loss of a family member.

The Process of Inheritance Allocation

Navigating the process of inheritance allocation in Islamic law can initially seem complex, but understanding the steps involved can simplify things. The first step involves identifying the estate’s value and the rightful heirs. This process demands accuracy, ensuring that every entitled person gets their legitimate share as per Islamic guidelines.

Family members play a significant role, typically falling into two main categories: fixed heirs (‘ashab al-furud’) and residuary heirs (‘asobah’). Fixed heirs include specific relatives like spouses, parents, or children, who are designated certain portions. After assigning the fixed shares, residuary heirs may inherit the remaining estate. Understanding these categories helps in accurate inheritance distribution.

To ensure fairness, the calculation of shares must follow detailed rules outlined in Islamic teaching. For example, a son generally receives twice the share of a daughter. While this may appear unequal modernly, it’s based on traditional roles where men bear greater financial responsibility. Still, differing cultures and financial circumstances today can create tension, sparking debate on this traditional rule.

Despite possible challenges in aligning ancient rules with modern-day realities, these calculations strive for fairness by considering immediate family needs first. The process encourages family unity through equitable treatment, reducing potential conflicts over wealth distribution.

Understanding these steps is crucial not only for those directly involved in such situations but also for anyone exploring the application of traditional laws in modern life.

Rights and Responsibilities of Heirs

In Islamic inheritance, heirs shoulder specific responsibilities that go well beyond just receiving their designated shares. Heirs are expected to contribute towards fulfilling the deceased’s obligations, such as settling debts and funeral expenses, before distributing the remaining estate. These duties underscore the holistic nature of Islamic inheritance principles, which prioritize ethical obligations and community welfare.

Women’s rights in Islamic inheritance often stand out because of the deliberate effort to secure their share, which was quite revolutionary at the time these laws were introduced. Women, while traditionally receiving half the share of their male counterparts, are entitled to inherit and manage property independently, enhancing their financial autonomy.

Children, especially minors, also hold particular rights in Islamic inheritance. Safeguards are in place to ensure their wealth is preserved and managed skillfully until they reach maturity. This protection means that even if a child’s share seems small in proportion, the focus is on long-term security and welfare, ensuring they face fewer financial hardships later on.

However, with rights come potential challenges. Disputes and resentment can arise when interpretations differ or when modern contexts clash with traditional rulings. For instance, the perception of unequal treatment can trigger conflicts, especially when aligned with cultural shifts towards gender equality.

In navigating these sensitive issues, the importance of communication within families cannot be overstated. Discussions ideally take place early, often involving Islamic scholars or legal advisors, who can offer clarity and mediation if required. Proper guidance can help resolve potential disagreements harmoniously, maintaining family unity while respecting Islamic teachings.

Example of Faraid Calculation : https://vt.tiktok.com/ZSjV7HGcb/

Case Studies and Practical Applications

Real-world examples help illuminate the principles of Islamic inheritance, turning abstract rules into tangible lessons. Notable historical cases offer insights into how these laws have been applied over centuries. By analyzing past disputes or successful executions of inheritance distribution, we gain an understanding of the practicalities involved.

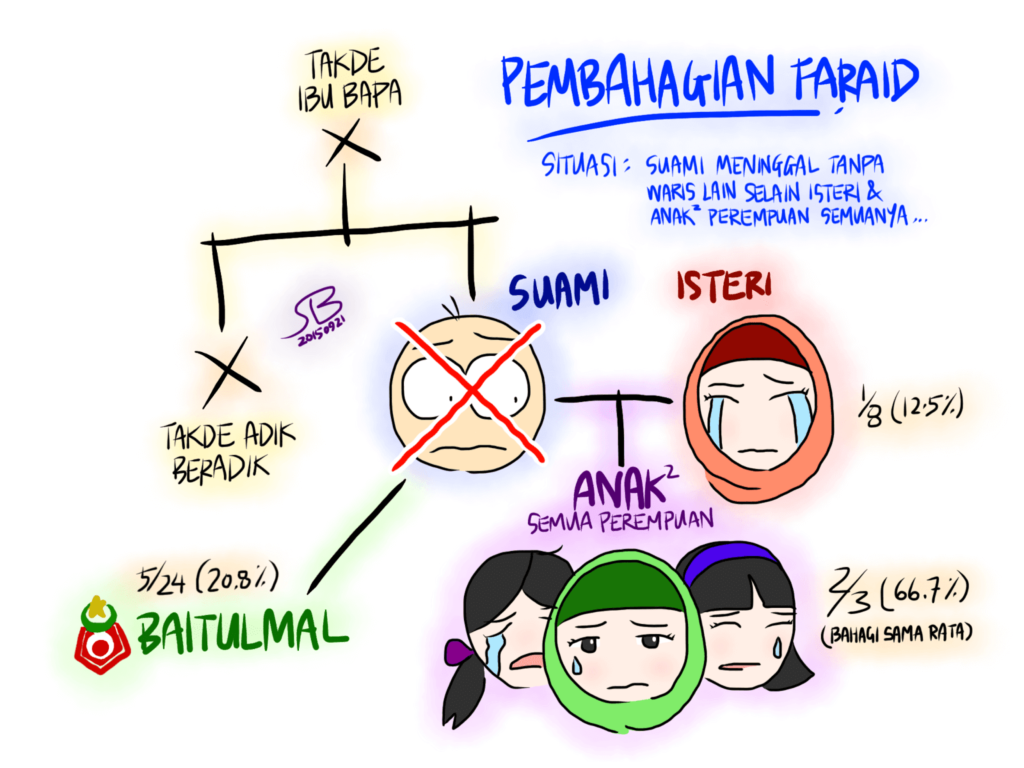

Imagining hypothetical scenarios further clarifies these laws in action. For instance, consider a family where the father has passed away, leaving behind a wife, two sons, and a daughter. According to Islamic law, the wife would receive one-eighth of the estate, as there are children, while each son receives a larger share than the daughter, owing to traditional financial responsibilities placed on males. By working through these cases, the allocations start to make sense, revealing the inherent logic in their structure.

Common issues in contemporary inheritance settlements often stem from modern circumstances that differ from traditional contexts. For example, significant assets like overseas properties or modern investments were not accounted for in ancient times. This gap requires careful navigation, often with the help of legal experts who can bridge traditional teachings with present-day realities.

These case studies provide more than just lessons in distribution; they also illustrate the flexibility and challenges within the system. Practical applications show how families adapt, interpret, and sometimes contest these traditional rules, highlighting the dynamic nature of Islamic inheritance laws amid changing societal norms.

Providing this big-picture view assists individuals and families in preparing for these challenges, ensuring that when the time comes, they can apply the rules effectively while respecting both tradition and contemporary needs. Engaging with these examples and learning from history can make navigating your family’s inheritance journey smoother and more informed.

Putting knowledge into action is important to avoid misunderstanding. Here’s a sharing on my Tiktok

Navigating Modern Challenges and Legalities

Modern realities present unique challenges when adhering to Islamic inheritance laws, especially for those living in non-Muslim countries. These legal environments might not automatically recognize Islamic principles, demanding creative strategies to balance religious adherence with local laws. This complexity often calls for legal interventions like setting up Islamic wills or trusts, ensuring alignment with both Islamic and state regulations.

It’s essential for Muslim families to seek guidance from experts familiar with both realms. Lawyers versed in Islamic inheritance can tailor solutions that honor religious duties while complying with local legal standards. Financial advisors specializing in this field can also offer crucial help, particularly when dealing with complex assets like foreign investments.

Countries differ widely in how they accommodate personal religious practices within secular legal systems. For instance, some places might allow the application of Islamic laws through specific legal documents, while others might require more comprehensive estate planning methods. Navigating these differences necessitates careful consideration and professional advice, ensuring that one’s religious obligations are met without unnecessary legal conflict.

Contemporary challenges also mean addressing inherited practices that might not fit neatly with today’s societal norms. Holding onto the core values of equity and justice while adapting to modern realities involves open dialogue and sometimes reform, where permitted. This adaptability ensures that Islamic inheritance remains relevant and applicable no matter the changes in societal structures.

Ultimately, navigating these modern challenges is about more than just legal conformity. It’s about maintaining the integrity of one’s faith while responsibly managing familial obligations amidst a backdrop of ever-evolving legal landscapes. Equipped with the right knowledge and guidance, families can ensure that they honor both their religious beliefs and their legal environments effectively.

It is every Muslim’s responsibility to plan and manage their assets and wealth during lifetime. Lets not risk your assets to fall into the Frozen Estate. For further details, click https://wa.me/message/V4TLTXLZMZSWD1