Estate planning is often overlooked, yet it is a crucial aspect of financial security, especially for Muslim women. Many assume that inheritance laws under Faraid (Islamic inheritance law) automatically ensure their financial well-being. However, without proper planning, women—whether as wives, mothers or daughters —may face financial instability and legal complications.

So in this article, let us go through why Muslim women need estate planning. First of all, let’s understand the challenges we face.

Understanding the Challenges

1. Faraid Distribution May Not Be Sufficient

Faraid ensures that assets are distributed according to Islamic principles, but the allocation might not always meet a woman’s financial needs.

For example, a wife typically receives only 1/8 of her deceased husband’s estate if they have children, and this may not be enough to support her long-term.

Additionally, daughters may inherit half of what their male siblings receive, which can be a concern if they are financially dependent on the inheritance.

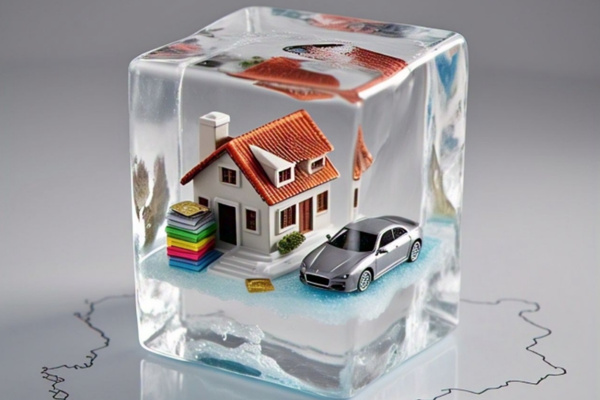

2. Risk of Frozen Assets (Harta Beku)

When a person passes away without proper estate planning, their assets can become frozen due to legal and procedural complications.

This can leave widows and children struggling financially while waiting for inheritance distribution. The process of unlocking frozen assets can be time-consuming and expensive, adding further hardship to grieving families. In many cases, widows assume that they can claim their husband’s left behind wealth “automatically”.

However, this is not true. The fact is that they need to go through a lengthy process to claim the estate left behind. The process requires advance cash and time which may cause unnecessary stress.

Did you know? According to a news article published by Berita Harian dated 23 February 2025, there are “RM65 billion in property asserts and cash belonging to deceased individuals still failing to be handed over to their heirs until now.”

3. Challenges Faced by Widows and Single Mothers

In many cases, widows and single mothers do not have immediate access to their late husband’s or father’s assets. This can create financial difficulties in managing daily expenses, children’s education, and future security.

Without sufficient estate planning, these women may be forced to rely on extended family members for financial support, which may not always be reliable or available.

4. Dependence on Male Guardians

Islamic law places financial responsibility on male guardians, but in modern times, many women contribute to household expenses or even become the main breadwinners.

In situations where a woman’s guardian mismanages funds or refuses to provide financial support, she may face economic vulnerability. Estate planning ensures that women have financial security and control over their assets, reducing their dependency on male relatives.

5. Inheritance Disputes and Family Conflicts

In some cases, family members may dispute inheritance claims, leading to prolonged legal battles and financial uncertainty.

Disagreements over asset distribution can create rifts among family members, especially in cases where multiple heirs are involved.

Proper estate planning can help minimise conflicts by clearly outlining asset distribution through legal instruments like hibah and wasiat.

Naturally, this point applies universally to Muslims and non-Muslims.

6. Limited Knowledge and Awareness of Estate Planning

Many Muslim women are unaware of their rights and the various tools available for estate planning.

Due to a lack of financial literacy and legal understanding, they may not take proactive steps to secure their future.

Awareness campaigns and professional guidance are crucial in empowering women to make informed decisions regarding their wealth. Many women, especially housewives and stay-at-home mothers, play a crucial role in managing household finances but are often unaware of their rights and the estate planning tools available to secure their future. Without proper knowledge and planning, they may face financial difficulties if their spouse passes away unexpectedly.

Let us examine deeper some of these points:

Tools for Effective Estate Planning

What tools can we use for effective estate planning? Here are 4 immediate financial tools you can take action immediately.

1. Hibah (Islamic Gift)

Hibah allows a person to gift assets to their loved ones while still alive. For Muslim women, receiving hibah from parents or husbands can provide financial stability without being subjected to faraid distribution. It is a powerful and flexible estate planning tool that provides Muslim women with financial security, prevents inheritance delays, and reduces legal complications.

By using hibah, women can ensure they receive assets immediately, without waiting for court processes or inheritance distribution under Faraid.

Let us go through a few scenarios.

How Hibah Safeguards Assets and Prevents Inheritance Disputes

2. Wasiat (Islamic Will)

A wasiat allows a Muslim to allocate up to one-third of their estate to non-faraid beneficiaries, such as adopted children, non-Muslim family members, or even charity.

In Islamic estate planning, wasiat (Islamic will) is a crucial tool that allows a person to allocate up to one-third (1/3) of their estate to non-Faraid heirs or charitable causes. While Faraid determines the fixed distribution of assets among legal heirs, a wasiat provides greater flexibility to ensure financial protection for specific individuals, particularly women who may otherwise receive limited inheritance under Islamic law.

For Muslim women—whether as wives, mothers, daughters, or single women—a wasiat can secure financial stability, reduce inheritance disputes, and provide immediate support after a loved one’s passing.

3. Takaful (Islamic Insurance)

Takaful can serve as a financial safety net for Muslim women by ensuring they receive financial aid, especially in the event of a spouse’s or parent’s death. Here are some examples of real case studies throughout my work experience:

Scenario 1: Protecting Daily Living Expenses

Situation: A housewife, Aida, has been financially dependent on her husband, who was the sole breadwinner. He suddenly passes away due to a heart attack. Without his income, Aida struggles to pay household bills, groceries, and other daily expenses.

How Takaful Helps: If her husband had a Family Takaful plan, she would receive a lump sum payout that could sustain her and their children while she finds alternative financial support.

Scenario 2: Settling Outstanding Debts

Situation: Farah’s husband took a home loan under conventional financing. Upon his passing, the bank demands the outstanding mortgage balance. Without a source of income, Farah risks losing their family home.

How Takaful Helps: If her husband had Mortgage Reducing Term Takaful (MRTT), the outstanding loan would be covered, ensuring she and her children can continue living in their home without financial stress.

Scenario 3: Education Fund for Children

Situation: Nora is a stay-at-home mom with three young children. When her husband passes away in a car accident, she worries about how to fund their education.

How Takaful Helps: A Child Education Takaful Plan taken by her husband would provide a payout, allowing the children to continue their education without disruption.

Scenario 4: Immediate Funeral and Emergency Expenses

Situation: When Sarah’s husband dies unexpectedly, she needs funds for funeral expenses, hospital bills, and other immediate costs.

How Takaful Helps: With a Takaful Protection Plan, she receives a quick payout to cover these urgent expenses without borrowing money.

Scenario 5: Monthly Income Replacement

Situation: As a full-time housewife, Lina relied entirely on her husband’s salary. When he passed away, she had no immediate income source.

How Takaful Helps: Some Family Takaful Plans offer a structured payout, providing a monthly income for a specific period, helping her manage household finances while she plans her next steps.

These examples explain how Takaful serves as a financial safety net for women, especially housewives, ensuring they and their children are not left struggling after the loss of the family’s primary provider.

4. Nomination in EPF and Takaful Policies

EPF Nomination

The Employees Provident Fund (KWSP/EPF) is an important retirement savings scheme for Malaysians, including Muslims. However, the nomination process for Muslims follows specific Islamic inheritance (faraid) principles.

This is how KWSP nomination works for Muslims:

- Nominees act as trustees, not owners – unlike non-Muslims, a Muslim nominee cannot keep the entire KWSP savings unless it aligns with Faraid or estate planning instructions.

- The nominee must distribute the money based on faraid unless the deceased made a valid wasiat (Islamic will).

- Only up to 1/3 of the estate can be given to non-faraid heirs.

- The heirs agree through sulh (mutual agreement) on an alternative distribution.

- Faraid Distribution for KWSP Savings

If the deceased did not make any estate planning, KWSP savings must follow faraid.- Example of Faraid Distribution (Married Muslim Male with Parents & Children)

Faraid Heirs and Share

– Wife 1/8

– Sons 2:1 ratio vs daughters

– Daughters Half of son’s share

– Father 1/6

– Mother 1/6

- Example of Faraid Distribution (Married Muslim Male with Parents & Children)

- If no heirs claim within two years, KWSP will transfer the funds to Amanah Raya (unclaimed estates)

Takaful Policies Nomination

Let us also understand the importance of making a nomination for your Takaful policies.

The following are some case studies highlighting the need to make a nomination in our Takaful policies:

Case 1: Nomination Ensures Immediate Payout

Situation: Aiman, a husband and father of two, passed away unexpectedly. He had a Takaful Family Plan but did not nominate a beneficiary. As a result, the payout became part of his estate and had to go through the Faraid process, causing months of delay. His wife, Siti, struggled financially as she had no immediate access to funds for daily expenses.

If Aiman had nominated his wife, she would have received the payout directly within weeks, giving her financial security while handling other legal matters.

Case 2: Avoiding Disputes Among Heirs

Situation: Ali had a Takaful policy worth RM500,000. He assumed the payout would automatically go to his wife, Aida, after his death. However, since he did not make a nomination, the funds had to be distributed according to Faraid, which meant his parents and siblings also had claims. Aida had to negotiate with them, delaying access to the funds.

If Ali had nominated Aida, she would have received the full amount as a hibah (gift), avoiding legal delays and family disputes.

Case 3: Ensuring Financial Stability for a Special-Needs Child

Situation: Hakim and his wife, Laila, have a son with special needs. Hakim passed away, and his Takaful payout had to go through Faraid, where the amount was distributed among multiple heirs. Laila faced difficulties securing enough funds to continue their child’s specialised care.

If Hakim had nominated Laila, she would have received the full payout immediately, ensuring financial stability for their son without legal complications.

By properly nominating beneficiaries, women can secure immediate financial support without assets being frozen in legal processes. This step is especially important for housewives, single mothers, and families with young children, ensuring they have the financial means to move forward.

Take Action

Now that you have a greater awareness of why Muslim women need estate planning, it is time for you to take action and take charge of your life.

Here are some actions to do:

1. Understand Your Rights and Options

First of all, be aware of your own list of assets and list down all your beneficiaries. Have a clear mind about who you wish to give away your assets to.

If you need more clarifications or ideas on how the distributions can be made, you can always contact me or my team at ERA Advisory to assist you.

2. Discuss Estate Planning with Your Family

Open discussions with spouses, parents, and children about estate planning can help prevent future conflicts and misunderstandings. Indeed, this can be a sensitive topic to talk about.

However, it is important to initiate the discussion with your husband and family members. Here are some approaches you may try on how to start a conversation with your husband about estate planning:

Choose the Right Time & Setting

Pick a moment when both of you are relaxed—perhaps after dinner, during a weekend coffee break, or while driving together. A calm, distraction-free environment makes it easier to have an open discussion.

Start with a Real-Life Example

Bringing up a real-life situation can make the topic feel more relevant.

“I heard about someone who lost her husband unexpectedly, and she struggled financially because they never discussed estate planning. I don’t want us to be in that situation.”

This makes it clear that you’re coming from a place of care, not fear.

Express the Importance of Planning Together

Let your husband know that estate planning isn’t just about finances—it’s about securing your family’s future. Instead of making it seem like a daunting task, highlight the benefits:

- Preventing family disputes

- Ensuring financial security for the wife and children

- Avoiding delays in accessing assets

- Making informed decisions together

Ask Open-Ended Questions to Encourage Discussion

Rather than making demands, ask thoughtful questions to get his perspective:

“Have you ever thought about what would happen to our assets if something happened to us?”

“Do you know if your Takaful nomination is up to date?”

“How do you feel about setting up a simple plan to ensure our family is protected?”

Highlight the Risks of Not Planning

Many families face financial difficulties after a sudden loss because assets become frozen in legal processes. If a husband does not nominate his wife properly, she may have to go through lengthy Faraid distribution or legal procedures before receiving financial support.

Example: A woman struggles to pay for daily expenses after her husband’s passing because his Takaful payout has to go through estate distribution instead of being given directly to her. A simple nomination could have avoided this.

Take the First Step Together

Start small by reviewing existing financial documents, Takaful nominations, and wills. If nothing is in place yet, suggest speaking to an estate planning professional.

“Maybe we can just check what we already have in place and see if we need to update anything.”

Estate planning is not about expecting the worst—it’s about making sure your family is prepared for the future. By having this conversation early, you can prevent legal complications, financial stress, and family disputes. Approach it with love and care, emphasising the need to protect each other and your children.

3. Consult an Estate Planning Professional

Seeking advice from professionals ensures that estate planning documents are prepared correctly, minimising legal complications.

Estate planning involves legal and financial decisions that can have a long-term impact on your family’s financial security.

While many people assume they can handle it on their own, mistakes in estate planning can lead to legal complications, delays, and unintended asset distribution.

Consulting professionals—such as estate planners, lawyers, and financial advisors—help ensure that your documents are properly structured and legally valid.

Key Takeaways

Proper estate planning is essential for Muslim women to secure their financial future, protect their children, and prevent unnecessary financial struggles.

By understanding the tools available and taking proactive steps, women can ensure their well-being and that of their loved ones.

If you’re a Muslim woman or know someone who needs estate planning advice, now is the time to act.

I encourage you to reach out to people you know who can provide professional estate planning advice. If you do not have anyone around you who can guide you on this, you can always reach out to me below.