Have you ever had a dream or ambition of becoming an Islamic Financial Planner? It’s an interesting question to ponder, and truth be told, it was never something I ever thought about as a career in my earlier days.

When I was in primary school, my ambition was like many other girls, “I want to be a teacher”. Most probably, the exposure or surrounding environment children had at that age are only their teachers.

Anyway, when I was in my secondary school days, my ambition changed. I then switched my dream to becoming a corporate worker. During that time, I wasn’t exactly sure what I wanted to be, but what I had in my mind was an image of a job in which I worked in an office, had my own office and workstation, handled projects, attended meetings and looked professional. hehe…

Is a career as a Financial Planner considered a dream job? Not that I know of. As far as I know, people dream of being doctors, pilots, businessmen, astronauts, speakers and so on.

Never have I heard before that someone wants to grow up to be a financial planner simply because not many people are even aware of the job/duties of a financial planner. It is not a career which is being promoted widely and explained to the students throughout their education journey. Even parents, not many are aware of the functions of a financial planner.

What Inspired Me To Be An Islamic Financial Planner?

So why did I choose to become an Islamic Financial Planner?

Ever since I have become a revert to becoming a Muslim, I have been praying to Allah SWT for a career which brings me closer to HIM. I told myself, since I am such a workaholic and love to devote my time to work, I need a career which makes me spend time on work and religion at the same time.

So, I prayed to ALLAH to grant me a career which brings me closer to Islam, a career which allows me to learn more about Islam, a career in which I can leverage the strength Allah has given me. This thought has always been in my prayer.

Alhamdulillah (All praise and gratitude belong to Allah (God))!

An Opportunity to be an Islamic Financial Planner

Five years ago, fate smiled upon me when a golden opportunity presented itself!

Two financial industry “angels” approached me with an invitation to join them on their new business adventure. These two extraordinary individuals had already achieved remarkable results in their 30-year careers, and they were now poised to take on the vast blue ocean of the financial industry with a new venture.

I was thrilled and humbled that they saw potential in me to be part of their team. I am excited at the possibility of working alongside these experienced and reputable personalities! It was an opportunity of a lifetime for me to learn from the best and be part of their expansion plans.

Moreover, with the low financial literacy rate in Malaysia, the market for financial planning had enormous potential. It was not just a chance to learn and grow, but also to make a meaningful impact in people’s lives.

Well, opportunity seldom knocks twice. So I accepted the invitation and it has been a journey of excitement, challenges, and rewards ever since!

What is Islamic Financial Planning?

Islamic Financial Planning is a holistic approach to evaluate a person’s current financial situation and help them to develop a plan to achieve their short and long-term financial goals according to the Syariah guidelines.

Syariah, which means the path to the water source, is filled with moral purpose and lessons on the truth. At its core, Shariah represents the idea that all human beings and governments are subject to justice under the law.

In Islamic finance, the Syariah guidelines summarise a way of life prescribed by Allah SWT for his servants and it extends to everything from business contracts, marriage, punishment and worshipping. A common term would be “Shariah-compliant” to describe that anything which is permissible under Islamic Law.

What Does an Islamic Financial Planner Do?

So, ya… many people ask me, “What does an Islamic Financial Planner really do and how did you kick start this career?”

A very good question indeed!

In fact, from my quick survey, I realised that many Malaysians have a misconception and misunderstanding that Financial Planning is insurance and investment. In fact, an Islamic Financial Planner is a professional service that combines Syariah investment advice, risk management, tax planning services, zakat, retirement planning and Islamic estate planning with the aim to help a person achieve their financial goals guided by the Syariah-compliant way.

Therefore, it is an Islamic Financial Planner’s duty to provide professional advice in this manner. It is important for all Muslims to be aware that as per the Islamic Finance manner:

- Wealth must be accumulated in an absolutely honest manner.

- Wealth must be managed in a highly responsible manner to benefit not only its owner and family but also the community.

- Wealth does not in any way distract Muslims from their faith in Allah SWT

I personally find this job very interesting as I (as a Khalifah) am helping Allah SWT to reach out to as many Muslims as possible to share the knowledge of Islam and help them in planning their wealth, the right way!

Rewards of Being an Islamic Financial Planner

What attracted me more to become an Islamic Financial Planner was the part where I could learn more about Islam while I carried out my day-to-day job activities.

To me, Islam is so beautiful as it is so complete that the Shariah principles in wealth management are derived from the al-Quran and the al-Sunnah and the rules governing acquiring wealth.

Everything in our life is guided by Islam and we will not go wrong if we understand its rationale and follow through.

“The example of those who spend their wealth in the way of God is like a seed [of grain] which grows seven spikes; in each spike is a hundred grains. And God multiplies [His reward] for whom He wills. And God is all-Encompassing and Knowing.”

[Quran 2:261]

My Education and Certification Roadmap to Become an Islamic Financial Planner

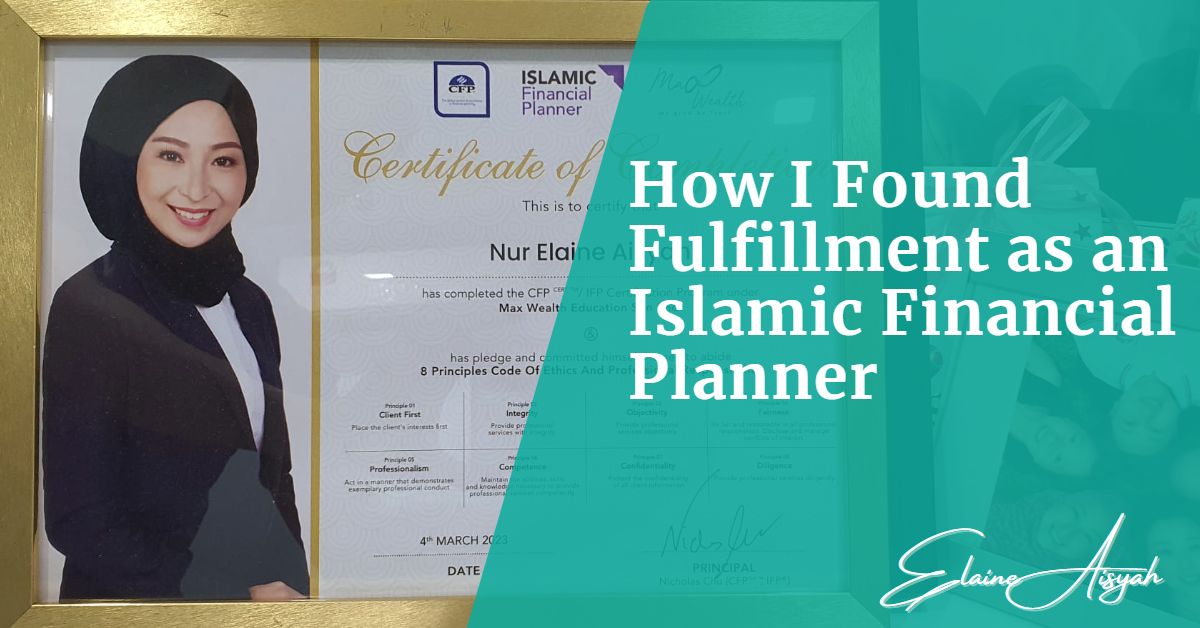

There are a lot more insights and knowledge we can gain from being an Islamic Financial Planner, which I am still doing my best to catch up on each day. Whatever it is, I am grateful to have passed my CFPCERT TM Certification (Certified Financial Planner) examination, IFP (Islamic Financial Planner) examination, and Islamic Estate Planner (IEP), all in one year!

I am now professionally equipped to have the capability to identify the financial needs of each individual and this allows me to provide better consultation for the benefit of each and every client.

Being a Muslim revert, I believe ALLAH SWT accepted me for a reason. My aim is to do more and do my best to help more people (Muslims and non-Muslims) around me.

As far as financial planning is concerned, there are many Muslims who are in need of this. There is a growing demand among Muslims calling for higher standards, ethical practices, reliability, and accountability in Islamic financial planning. And I am blessed to be of service to my fellow brothers and sisters.

How to Become an Islamic Financial Planner

If my story resonates with you and you are thinking about looking for a career switch, feel free to reach out to me to find out more.

But in summary, the following is what you need to do to become a Certified Islamic Financial Planner.

In brief, there are 4 Modules to complete :

- Module 1 – Shariah & Major Components of Islamic Financial Planning

- Module 2 – Islamic Risk Management, Estate & Waqf Planning

- Module 3 – Islamic Investment, Retirement, Zakat & Tax Planning

- Module 4 – Islamic Financial Plan Construction & Professional Responsibilities

Based on your preference, there are various education service providers that you can choose to enrol with and get yourself certified.

The road to success is never easy, but that is how we grow, and it will be worth it. I always believe that If there is a Will, there is a Way. It is important for us to identify what is our life goals and make plans towards achieving these goals.

Connect with Me

I hope you have enjoyed reading this post as I share my journey to becoming an Islamic Financial Planner. If I can be of assistance to you. You may also follow me on the social media of your choice(s) below to keep in touch!