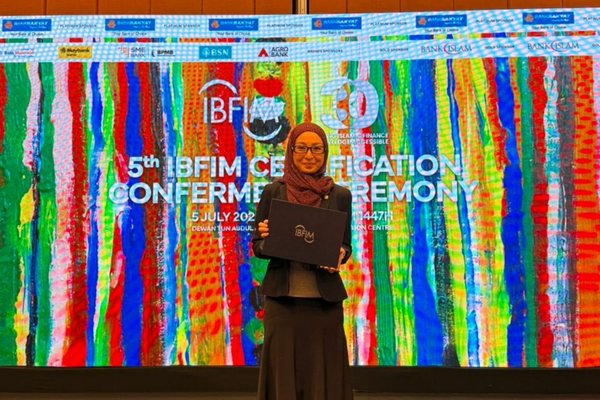

The 5th of July 2025 marks one of the most meaningful milestones in my career and personal journey. I’ve finally received my Islamic Financial Planner certification during the 5th IBFIM Certification Conferment Ceremony held at the Bank Rakyat Convention Hall, Kuala Lumpur.

Although I received the certificate by post two years ago due to COVID restrictions and the absence of a conferment ceremony, today, standing on stage to accept it in person from Yang Berbahagia Tn Yusry Yusoff, Chief Executive Officer of IBFIM, and surrounded by fellow financial professionals and respected leaders in Islamic finance, I felt a profound sense of gratitude, humility, and renewed purpose.

That moment on stage was more than just receiving my qualification formally. It was an affirmation about answering a higher calling to serve my clients and community with both financial wisdom and spiritual sincerity.

The Start of a Purposeful Journey

As a financial planner who embraced Islam many years ago, the idea of integrating faith and finance had always been close to my heart.

I had long observed that while many Muslim families work hard to build wealth, they are often unaware of how to manage, preserve, or distribute it according to Shariah principles.

I knew I wanted to offer more than just conventional financial advice. I wanted to confidently guide my clients through solutions that are ethical, holistic, and aligned with Islamic values.

That’s when I decided it was time to pursue the Islamic Financial Planner certification offered by IBFIM—a recognised qualification for professionals who aspire to bridge Islamic teachings with modern financial planning.

What Makes Islamic Finance Unique?

Through the IFP program, I deepened my understanding of what truly distinguishes Islamic finance from conventional finance, not just in structure, but in philosophy.

It is not simply about removing interest or avoiding haram elements. It’s a comprehensive system that reflects a just, compassionate, and balanced way of managing wealth.

Here are just a few of the key differences that struck me during my studies:

- Riba-Free Transactions: Islamic finance prohibits interest (riba), ensuring that wealth is not earned through unjust or exploitative means.

- Risk Sharing Over Risk Shifting: Structures like mudarabah and musharakah encourage partnerships where both parties share profits and losses.

- Asset-Backed Financing: Transactions must involve real assets or services, promoting transparency and reducing speculation (gharar).

- Ethical Investments: Investments are screened to avoid sectors like alcohol, gambling, pork, and usury.

- Social Justice Mechanisms: Tools like zakat, waqf, and faraid ensure wealth circulates fairly within society, supporting those in need.

What stood out the most for me is how Islamic financial planning doesn’t just manage money. It preserves dignity, upholds family values, and protects the next generation.

The Day of Conferment: A Moment of Honour

The ceremony on 5th July began with the arrival of guests and VVIPs, and by 8:30 AM, all conferees—including myself—entered the grand hall.

As we took our seats, I couldn’t help but reflect on the hours of study, discussions, and self-discipline that brought me to this point.

The program began with the National Anthem ‘Negaraku’ and a heartfelt doa recitation, setting a spiritual tone for the morning. En. Yusry Yusoff, CEO of IBFIM, then gave his welcoming address, reminding us that our role goes beyond the title—we are part of a growing movement to shape ethical finance in Malaysia.

Next, YBhg. Dato’ Adissadikin Ali, Chairman of IBFIM, delivered a powerful message on the importance of upholding Shariah values in the financial industry. He spoke of our duty to lead with trust, to always put clients’ well-being first, and to represent integrity in an industry that so often chases numbers without soul.

Witnessing a Diversity of Expertise

The conferment ceremony continued with a presentation of various certifications:

- AQIF (Associate Qualification in Islamic Finance)

- FCIB (Fundamental Certificate in Islamic Banking)

- iPCC (Islamic Professional Credit Certification)

- IQIF (Intermediate Qualification in Islamic Finance)

- CPSA (Certified Professional Shariah Auditor)

Each name called was a reminder of how broad and vibrant the Islamic finance sector has become—bankers, auditors, credit professionals, takaful experts, and planners, all contributing their expertise to a shared mission.

At 11:00 AM, the moment I had been waiting for arrived. My name was called among the recipients of the Islamic Financial Planner (IFP) certification. As I walked to the stage, I silently made a prayer of gratitude. This wasn’t just a certificate—it was a symbol of responsibility, trust, and commitment to serve with sincerity.

How the IFP Certification Elevates My Career

This certification is a major career milestone, and here’s how it supports my mission as a financial planner and estate planning consultant:

✅ Builds Professional Credibility

Clients, especially Muslim families, now have greater confidence in the guidance I provide—knowing it is backed by both practical expertise and Shariah understanding.

✅ Expands My Advisory Scope

With the IFP qualification, I can now offer a complete financial solution that includes:

- Takaful and risk management

- Islamic estate planning (hibah, wasiat, faraid)

- Zakat calculation and planning

- Shariah-compliant investment recommendations

✅ Aligns My Practice with My Faith

This certification has strengthened the alignment between my personal values and my professional goals. It allows me to run my practice with peace of mind, knowing I am serving both my clients and my Creator with integrity.

✅ Gives Me a Competitive Edge

As the Islamic finance space continues to grow in Malaysia, IFP holders are increasingly seen as valuable assets in financial institutions and advisory firms. It sets me apart in a crowded market.

✅ Empowers Me to Educate the Community

Whether through blogs, seminars, or client consultations, I now feel better equipped to raise awareness about Shariah-compliant planning and help more families make informed, faith-based financial decisions.

Reflections and Gratitude

Behind every certificate is a journey, and mine was filled with learning, self-reflection, and growth. I want to extend my heartfelt appreciation to:

- My family – for always supporting and giving me space to grow.

- My mentors and teammates at ERA Advisory – who challenged and encouraged me to pursue this path.

- The team at IBFIM – for delivering world-class Islamic financial education that is both intellectually rigorous and spiritually meaningful.

What’s Next? Leading With Purpose

With the IFP in hand, I am more focused than ever on my mission:

To help Muslim families protect their wealth, plan their legacy, and make financial decisions that are not only profitable—but also permissible and purposeful.

I plan to:

- Offer more educational sessions on Islamic inheritance and hibah

- Write content that demystifies Islamic estate planning for the public

- Build holistic financial solutions that empower my clients for both dunya and akhirah

This journey from learning to leading has been incredibly fulfilling. It taught me that financial planning is not just about numbers, it’s about values, trust, and responsibility.

If you are a Muslim professional looking to align your finances with your faith, or if you’re simply curious about how Islamic financial planning works, I invite you to connect with me. I’m here to guide, support, and walk this journey with you.

“Wealth is a trust; let us fulfil it with wisdom and compassion.”

Let’s plan with purpose.

Let’s grow with guidance.

Let’s lead with faith.

— Elaine Aisyah, IFP

Certified Financial Planner | Islamic Financial Planner | Estate Planning Consultant